|

Getting your Trinity Audio player ready...

|

What Is Ethereum? A Beginner’s Guide

Introduction

The crypto world has a lot of assets. As a beginner, you must be aware of these major assets to start properly. One of these major assets is Ethereum. The digital currency and its blockchain are vital aspects of the crypto world. So, in this article, we will answer questions like “what is Ethereum?” “What is Ethereum mining?” “What are Ethereum 1.0 and 2.0 and their effects on the Ethereum Price?

Also, we will answer questions about buying ETH, investing in it, and the coin’s future. Knowing all these is important before you begin your journey as a trader. So, let’s get started.

What Is Ethereum?

If people say that Bitcoin is the future of money, what then is Ethereum? A lot of people who are new to the crypto ecosystem ask this question. Most of them see ETH as bitcoin’s competition. However, comparing them is wrong because the two cryptos have different aims, technology, and features.

Primarily, Ethereum is a decentralized network in blockchain technology. Ethereum’s network Ether powers this blockchain, and users can use ETH for various reasons. For example, users can use ETH for value transfer, make money from holding through staking, and as NFT storage. Also, users can trade ETH for other crypto, play games with it, and use it for social media purposes.

For many people, the next step of the entire internet will be Ethereum. They believe that Ethereum will represent web 3.0. Also, Web 3.0 will support DApps (Decentralized Applications), DeFi (Decentralized Finance), and DEX (Decentralized Exchanges).

History of Ethereum

Today, Ethereum sits next to Bitcoin as the second biggest blockchain in the world. This position was not always there from the start. The project started with Vitalik Buterin co-creating the projects as the answer to the issues of bitcoin.

In 2013, he published Ethereum’s whitepaper, where he talked about smart contracts. Also, he mentioned DApps in the document. Primarily, Ethereum aimed to unify the DApps already on existing blockchains. He believed that unifying DApps would keep their adoption steady.

Hence, Ethereum 1.0 came into the scene. It was like the Google Play Store, one space with different kinds of mobile applications. However, all mobile apps work by similar rules. However, ETH is not a centralized system like the Google Play Store this time. No developer can change the rules by which DApp functions on the blockchain network.

Indeed, building something like this was going to be expensive, so the founders of the project did a token presale. From the presale, they raised $18 million. So, they used the money to fund the whole project.

As part of the project, they built a foundation in Switzerland. The mission was to develop and keep the Ethereum network through this foundation. However, Vitalik later announced that the foundation would be an NGO. This announcement caused most of the other co-founders to leave.

What Is Ethereum Hard Fork?

In 2016, developers in the ETH network started DAO. The idea was to build a democratic group that could vote on the network for changes and proposals. However, the idea was almost ruined when someone hacked the DAO system and made away with over $40 million worth of Ether.

At this point, a Hard Fork was implemented in the Ethereum network, thanks to the DAO voting system. Primarily, the aim was to upgrade Ethereum 1.0 to a new protocol through a major software update and reverse the stealing. Finally, the whole fork was successful but maintained the name Ethereum. However, the main network became Ethereum Classic.

What Is EVM?

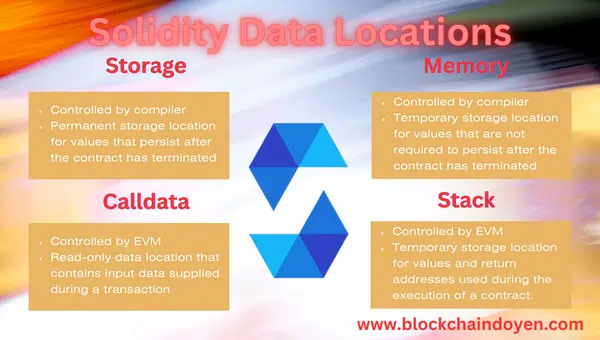

The Ethereum Virtual Machine (EVM) is a crucial component of the Ethereum blockchain, serving as a decentralized runtime environment for executing smart contracts. It provides a secure and isolated environment where developers can write and deploy their smart contract code.

The EVM operates on a stack-based architecture and uses a gas model to allocate resources fairly. By executing code on every node in the Ethereum network, the EVM ensures consensus and immutability of contract execution. Its versatility and robustness make it a fundamental building block for decentralized applications, enabling innovative use cases across various industries.

How Ethereum Works

Ethereum works with computer nodes, just like bitcoin. This way, the system is decentralized and secure from attacks. Also, no single person will be able to bring the system down. If one computer node goes down, the system will still be up because it has thousands of nodes ad participants.

So, the network is one decentralized system running on a computer called EVM (Ethereum Virtual Machine). In this computer, every node has an EVM copy. Therefore, everyone must agree to a verified transaction before a copy update.

The Ethereum Blockchain has blocks, and these blocks contain transactions. Moreover, Ethereum mining is the process through which the users validate the transactions in the blocks. The mining allows new blocks with verified transactions to be added to the network. The verification process in Ethereum mining is known as the PoW (Proof of Work) consensus mechanism.

In Ethereum mining, every block has a 64-digit code identity, and miners try to prove that code is unique. These miners use their nodes for this purpose. So, their computing power is their work proof, and the system rewards miners with more power with ETH.

What Is Ethereum Gas Fee?

The reward the system gives miners in Ethereum mining comes from a Gas Fee. A gas fee is a transaction fee users pay for using the network. So, the network gives that fee to the miner who validates the user’s transaction through Ethereum mining.

Also, it is noteworthy that the gas fee can get quite high sometimes. This hike is due to the activities on the network. The blocks in the network can hold transactions depending on the gas fees. So, miners tend to choose to verify the ones with high gas fees. In return, it becomes a competition for users. Everyone will want miners to confirm their transactions first. With this competition comes more gas fees leading to network congestion during busy periods.

Ethereum Applications

DeFi and DApps

One of the biggest goals of the network is DeFi. DApps came along around 2019, and since then, their use has experienced exponential growth. Also, the use of DApp means more use of the Ethereum network. Primarily, DApps is a means through which the network announced DeFi.

NFTs

Another use of the network is NFTs. They are unique digital artworks that belong to people, and these are built on the blockchain network. Primarily. The reason for hosting these apps on the blockchain is to show proof of ownership. So, with the artwork’s transaction on the blockchain, no one can claim ownership except the buyer.

Gaming

Most of these NFTs and DeFi apps on the network have been integrated into the gaming industry. So, people can now win game rewards as NFTs and transact them for cash or other cryptos on various platforms.

All these things are possible because of the smart contract feature of this blockchain.

What Is Ethereum Mining?

Ethereum mining is a process that allows nodes to add transaction blocks to the Ethereum network. The process currently uses the PoW mechanism. However, with ETH 2.0, the mining will use the PoS mechanism. The basic reasons for this move are to solve the network’s congestion, scalability, and environmental issues.

The mining process happens via miners, and these miners are computers. The computers run software that allows them to use their time and energy to validate transactions. So, when they validate, they add new blocks to the network. For the mining to be successful, the different miners on the network must agree that the transaction is valid. Furthermore, miners solve complex maths riddles to validate transactions in Ethereum mining.

Bitcoin vs. Ethereum

As we saw before, they are digital currencies giving different goals. Now, let’s see their differences.

| Bitcoin | Ethereum |

| BTC is the first cryptocurrency, founded in 2009. | It came along four years after bitcoin, specifically in 2013. |

| It is the most popular cryptocurrency. | It is the second most popular cryptocurrency. |

| Bitcoin focuses on just being digital money. | Ethereum focuses on developing DApps and Defi through smart contracts. |

| The network is just for bitcoin. | Developers can build other tokens on the network and make the interoperable. |

Pros and Cons of Ethereum

Pros of Ethereum

- The network is anonymous and decentralized.

- No central authority censors activities in the network.

- Only a user with 51% of the entire resources in the system can seize its control. However, it is practically impossible to own that much.

- The network replaces the need for trusted third parties with smart contracts.

- You can buy the network’s native coin on major CEX, DEX, and international payment gateways.

- The ETH buying and exchange process on these platforms is easy.

- It supports the interoperability of tokens and apps.

Cons of Ethereum

- The network has scalability problems due to its congestion caused by millions of users transacting.

- It uses the PoW mechanism, which is not naturally friendly.

- Transactions on the network can attract high gas fees sometimes.

- Developing the network is expensive. Moreover, it does not have good user interaction.

- Transacting with its coins on some platforms will need special digital wallets.

- You cannot do anything with Ether except hold it when you buy from payment gateways.

What Is Ethereum 2.0?

Ethereum Beacon Chain Merger

Gradually, Ethereum is upgrading to ETH 2.0. This version will use the proof-of-stake (PoS) mechanism rather than the PoW for Ethereum mining. The process has already begun and will be fully launched in September 2022. However, its fork will still maintain the PoS consensus mechanism.

ETH 2.0 newest feature will be its regular network’s merger with the Beacon Chain. Initially, there will be no visible change with the Beacon Chain integration on the network. However, the changes are there. It will only show up when there is a need for future upgrades. Also, Shard Chains will solve the issue of scalability with ETH 1.0.

Shard Chains and Ethereum Staking

The use of Shard chains is called Sharding. It simply means to share transactions on the network across other smaller networks on the blockchain. So, users who have weaker hardware can run smaller networks. The only thing they will do is store data from a specific shard instead of from the whole network. In essence, verifying transactions on the network will be more accessible, resulting in network decongestion.

Furthermore, to stake as a validator in ETH 2.0, you will need a minimum of 32 ETH. This amount will be just at the beginning of this migration. The system will reward validators with ETH for their efforts in connecting to the network. Moreover, the system believes that those who stake their coins want the best for the network. However, a validator can lose staked ETH for malicious acts or refusing to join. Lastly, enthusiasts believe that this PoS will have a positive impact on the Ethereum price.

Buying ETH

Firstly, the Ethereum price is valued in fiat currencies. However, it is determined by individuals. The price is based on the agreement between two individuals who want to exchange it as a currency. So, you will pay in fiat or another crypto based on the agreed Ethereum price.

Also, you can buy Ethereum through a crypto exchange or from an individual directly. In the crypto world, there are hundreds of exchanges to choose from. Again, the price can differ slightly in various exchanges.

How to Purchase Ethereum

Once you have determined the amount you want to buy based on the Ethereum price, choose your preferred exchange. Then follow the steps below to buy from that exchange.

- Open a trading account with the crypto exchange by signing up.

- Fund your account with your preferred currency as supported by the exchange.

- Once the money has been reflected, exchange your fiat for ETH.

- Alternatively, you can exchange your fiat for another coin, the swap to ETH based on the Ethereum price.

- Your transaction fees will be based on the Ethereum price on the exchange and the amount you buy.

- After the swap, you can send the coins to your cold wallet or leave them on the exchange.

Should You Invest in Ethereum?

ETH’s MarketCap has made it the most valued currency after BTC. Also, people who call Bitcoin “gold” call it silver. Over the years, the Ethereum price has increased because of its wide adoption in the industry. However, that should not be your focus because ETH is very volatile. So, just like every other crypto, it is a risky investment. Again, you know that the more the risk in an investment, the higher the reward.

Because of the Ethereum price volatility and the uncertainties in the market, please DYOR (Do Your Own Research) before you invest. However, investing in ETH is not bad if you want to diversify your portfolio. Most importantly, invest what you can afford to lose.

The Future of Ethereum

The Ethereum price and blockchain have increased in the last few months. Moreover, developers have built lots of DApps on the network. Today, we have Defi and NFTs on the network too. The various applications of the network have sparked up a huge effect already. More users and developers are getting interested in the network.

However, there are still unsettled issues about the network. Analysts still wonder if the blockchain is behind schedule with upgrades. They ask questions like, “what is Ethereum’s chance of competing with networks that have these upgrades already?

Although, some analysts still believe that ETH’s significance, in the long run, will reverse the crypto market. They believe that will get bitcoin back to unmatched dominance in the market.

Conclusion

We answered questions like “what is Ethereum?” “What is Ethereum Mining?” and “What is Ethereum Gas Fees?” in this article.

Also, we covered areas like its pros and cons, investing, future, buying, and so on. Indeed, if there is a time to pay attention to ETH, it is now. Specifically, because of the migration news, we might see another increase in the Ethereum price. So, learning this blockchain is the right thing to do now for every crypto enthusiast.